Notification No – 10/2019 has increased the limit for GST Registration to Rs. 40 Lakhs, In this article we are trying the analyse the GST registration provisions in the light of recent changes.

Who Should Register for GST?

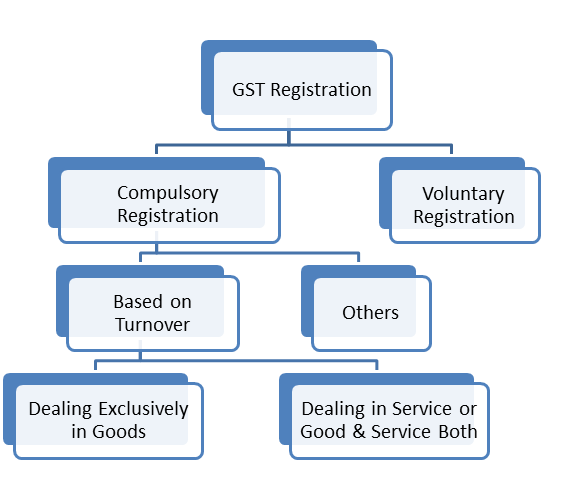

Registration provisions can be explained through the following diagram.

What will change after April 2019?

This can be explained through the following Tabular format –

| Condition |

Provisions before 31/03/2019 |

Provisions After 01/04/2019 |

| Person Engaged in Exclusive Supply of Goods |

If the aggregate TO under single PAN exceeds Rs. 20 Lakh for all over India (except the North Eastern States, i.e. Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura, Uttarakhand – TO Limit is Rs.10 Lakhs) need to get himself registered for GST |

If the aggregate TO under single PAN exceeds Rs. 40 Lakh for all over India(except the North Eastern States, i.e. Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura, Uttarakhand – To Limit is Rs.10 Lakhs ) need to get himself registered for GST

(NN – 10/2019 Applicable from 01/04/19

|

| Person Engaged in Exclusive Supply of Service or in Supply of Goods/Service Both |

If the aggregate TO under single PAN exceeds Rs. 20 Lakh for all over India (except the North Eastern States, i.e. Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura, Uttarakhand – TO Limit is Rs.10 Lakhs) need to get himself registered for GST |

If the aggregate TO under single PAN exceeds Rs. 20 Lakh for all over India (except the North Eastern States, i.e. Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura, Uttarakhand – TO Limit is Rs.10 Lakhs) need to get himself registered for GST

(No Change)

|

| Others – Who need to compulsory get themselves registered under GST. |

- Casual taxable person / Non-Resident taxable person

- Agents of a supplier

- Inter-State Supply of Goods ( Inter-State Supply of Service is exempt up to TO Limit)

- Input service distributor

- Those paying tax under the reverse charge mechanism on the specified goods

- A person who supplies via e-commerce aggregator/operator

- Every e-commerce aggregator/operator

- The person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered taxable person

|

| Voluntary Registration |

A person can apply for the registration even if his turnover from the business does not exceed thrash hold limit as explained above. |

How to compute Aggregate Turnover?

Aggregate Turnover is defined in section 2(6) of the GST Act; the analysis of the provisions can be made in the following points.

- Turnover of all the production and services need to be considered ( Taxable Supplies + Exempt Supplies + Nil Rated Supplies + Export Supplies )

- Turnover of the person for all the location under single PAN

- CGST/SGST/IGST/UTGST - Not to include in computing Turnover

- Reverse charge supply on which tax needs to be paid under Reverse Charge Mechanism - Not to include in computing Turnover

- Supply on own account as well as on account of the principal need to be included during calculation Threshold registration limit.

- Turnover needs to be computed from the start of the financial year.

Which place to Register?

The person having multiple places of business in the different state need to be registered in each such state separately. He can apply for multiple registrations in a single state also for different business verticals.

What Documents Required for GST Registration?

- PAN of the Applicant

- Aadhaar card

- Proof of business registration or Incorporation certificate

- Identity and Address proof of Promoters/Director with Photographs

- Address proof of the place of business

- Bank Account statement/Cancelled cheque

- Digital Signature (Compulsory for Company and LLP)

- Letter of Authorization/Board Resolution for Authorized Signatory

What is next?

After GST registration you need to reconfigure you billing system according to GST provisions and format, this is where Shimbi My Billing App can help you to generate hassle-free billing, get paid earlier and also reporting the same to you consultant for GST filing.

Further, you need to display the registration certificate at the place of your business and on the board of the entry of the principal place of business and every additional place of business.

What are the consequences of non-registration under GST?

A person not paying tax or making short payments (genuine errors/reasons) has to pay a penalty of 10% of the tax amount due subject to a minimum of Rs.10,000.

The penalty will at 100% of the tax amount due when the person has deliberately evaded paying taxes.

I hope this article will be useful to you for your business GST compliance.

Are you looking for a simple to use GST compliant invoicing software? Give a try to Shimbi Invoices. It has everything you'll ever need to manage your GST compliant invoicing.