Well, the title does require a bit of explanation... isn’t it?

When something does not make sense to you because you do not belong to the specific section of the industry/business/group, then such terms are called Jargons. It just needs a bit more explanation to understand the meaning for a layman.

JARGON

jargon

[jahr-guh n, -gon] 1. The language, especially the vocabulary, peculi ar to a particular trade,profession, or group: medical jargon. 2. Unintelligible or meaningless talk or writing; gi bberish. |

| http://dictionary.reference.com/ |

Jargons are special/specific words or expressions used within the context of a certain profession / industry, so that it is self explanatory for those involved in the same profession, but requires rephrasing and clear explanation to make sense to others who are outside of the said industry/profession.

However, this does not mean Jargons can be eliminated from the vocabulary. They are very much essential, as it saves time, explanation and speculation when used in the right context.

Today we are going to learn some Jargons used in Online Invoicing or Billing Applications such as ShimBi MyBilling.

(Business) Accounting

By systematic accounting, businesses keep track of the money that is put into the business in an orderly manner. Reports generated from accounting statements help in this matter.

Estimate

The purpose of the estimate is to get an idea about the costs involved, with the intent of ascertaining if it is affordable within the allocated budget . An Estimate is requested (or) sent after discussing the project in detail, so as to include cost-material-time-resource breakups.

Invoice

Invoices help track sale of a product / services. Not just this, invoices play a major role while filing tax, inventory control and other accounting purposes.

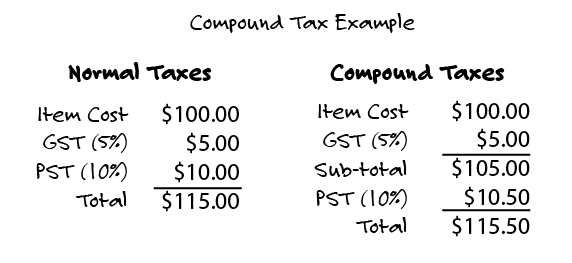

Compound Tax (or) Stacked Tax

In some cases Provincial Tax (PST) are applied to the invoice in addition to sales tax. Such transactions use Compound-tax to raise the final invoice amount.

Receipt

Receipts are issued when an invoice has been paid. Businesses also issue receipts to vendors for goods received, and other businesses for services rendered.

We hope today's blog post was useful to you. If you have any feedback or additions, please feel free to post them through comment section bellow.