Isn’t this how it generally chalks out?

You start a company and treat it like your baby. You work day and night to nourish it and grow it to the point of adolescence. This is the time when you buy an office, put a team in place and focus on growing your clientele. Revenues start to mount, and you start setting up financial systems in a bid to handle them.

This is where you make one of the most common management mistakes - using MS Excel to handle company finances.

Okay, okay! I hear you. Excel is indeed easy to use and is readily available on all systems. But as it often proves to be true in life, the easy way is not always the right way.

Excel can actually turn out to be toxic for your finances. I am sure that you would never choose convenience over revenue if you knew this.

Here is why excel is not for generating Invoices.

Let’s see how Excel can cripple your company’s finances and how invoicing software can save the day -

1. Haphazard Invoice Numbering

Have you ever been irritated by the fact that you have to always refer to past Excel invoices to manually number the new ones? Well, you’re not alone. This often leaves room for confusion and inconsistency, especially if multiple people are creating invoices.

Just imagine the consequences if two clients are sent the same serial numbered invoices. One of them is bound to be rendered invalid, and that can leave customers irritated (thus completing the chain of being pissed). And this is just the beginning of your woes. It can take up to 90 days for an organization to process an invalid invoice!

Surely you don’t want this.

Invoicing software aptly solve this issue by automatically numbering the invoices in the sequence in which they are generated. This keeps the integrity of your financial history intact.

2. Manual Accounting and Backup

Don’t you just hate it when you have to type the whole invoice over and again every time you sent it out? You might even remember the names and addresses of multiple clients by now (not something to be proud of FYI).

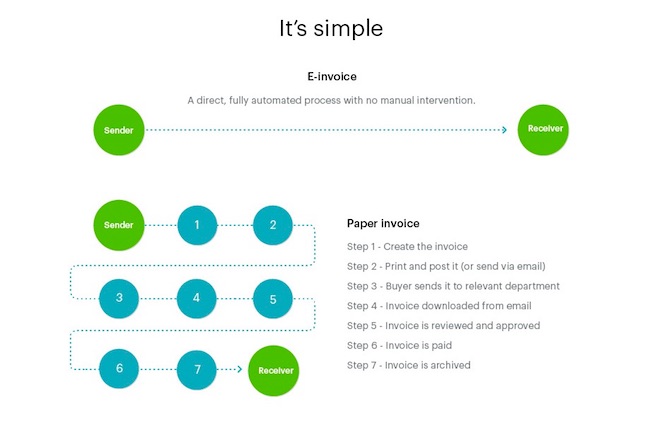

Excel also makes you dependent on outdated accounting methods. For example, you still need to print the invoices and file them before they are accounted. This tedious process often involves a lot of steps as given below:

- Creating the Invoice with Excel

- Printing it to post or emailing it

- Client receives the invoice and forwards it to the right department

- Invoice is downloaded from the email

- It is reviewed and approved

- It is then paid

- Invoice is finally archived.

Invoicing software make your life much easier by reducing this 7 step frenzy to a 2 step process:

- e-Invoice is easily created within a few seconds and sent

- It is received, reviewed and stored automatically.

Image Source: zervant

It can officially not get any better (unless you go and do your customer’s accounting for them).

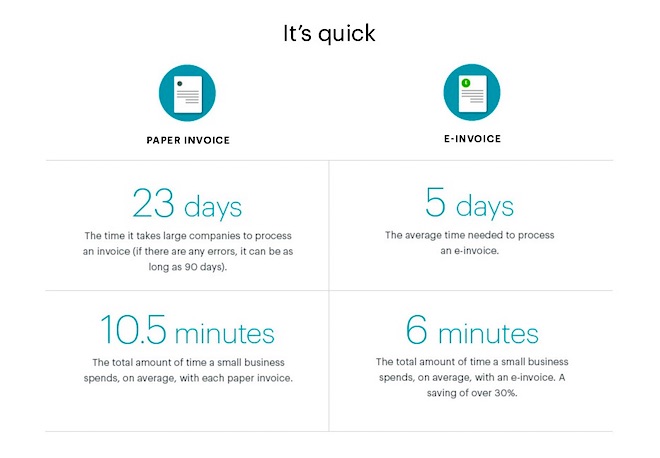

It takes 23 days (on average) to process a paper invoice and five days to process an e-invoice. The faster you invoice, the sooner you get paid. It’s that simple.

Image Source: zervant

Moreover, invoice automation can save you serious bucks by cutting down processing costs by 60%. This is reason alone to stop reading and start using an invoicing software right away!

But just in case, here’s more...

3. Error and Fraud Prone

Haven’t you ever realized how easy it is to manipulate Excel documents if they fall into the wrong hands? Anyone with access to the system can swoop in and exploit it before you can spell out the words ‘Oh my God!’

And even if you’re sure about your system’s security measures, Excel can still leave you low and dry with all the typos and wrong formulations that keep cropping up.

To give you a perspective, here is a case study to blow your mind. One of the largest banks in the world - JP Morgan, was once running a portfolio worth Billions of dollars (as it quite often does) in London. And guess what? It was all running on Excel. And not even in a sophisticated method involving automation and self-checking processes that you might be expecting, but by manually entering information and copy and paste them across spreadsheets, including basic accounting and invoicing.

You can guess what happened next. One or two typos here and there and the bank lost several Billions of dollars in the process (you might want to close your mouth at this point).

I hope this clears how expensive Excel can prove to be as it ends up compromising the efficiency to the core.

Invoicing software has been designed keeping this in mind and provides another level of security altogether. They offer access to only a designated bunch of heads who are officially in charge of your financial statements. This makes it a much better option than spreadsheets.

But that’s not it. The information that is often redundantly used can be saved and selected from a drop down list the next time you need it. This saves you from countless typos (as well as a receding hairline)!

4. Difficult to Collaborate

Image Source

Generating invoices is merely the first step. Once they are processed, invoices are used in many other integrated tasks such as -

- Planning

- Budgeting

- Reporting

- Forecasting

Your dependence on Excel for your invoicing needs adds to the fray since you have to carry out each of these four processes manually. Excel offers no incentive to drive these tasks and a lot of time is wasted which can be easily saved otherwise.

Since invoicing software keep an eye on the cash flows, they can promptly provide you with a bird’s eye view of the company’s finances via multiple reports. These can then be used to plan the budget and forecast future cash flows.

This is so much cooler than Excel.

5. Difficult to Scale

Like Bill Gates, Founder of Microsoft, puts it, “The first rule of any technology used in business is that automation applied to an efficient operation will magnify the efficiency. The second is that automation applied to an inefficient operation will magnify the inefficiency.”

How ironic that his theory can be applied to one of the most popular software created by Microsoft itself!

Data and analysis derived from Excel documents often act as fodder for other automation processes. If the data itself is corrupted and error prone, such a system will end up spreading the inefficiency like wildfire!

It is indeed funny how Excel often ends of shooting itself in the foot and proves to be detrimental to its own growth.

On the other hand, an invoicing software favors scaling to the point of thousands of monthly invoices. In fact, a large number of invoices are welcomed by the software since they are utilized in accurate forecasting.

6. Lack of Overview

As your business grows, so does your monthly requirement of documentations such as quotations, credit notes, and reminders.

They might seem too boring to care for, but it is crucial to managing them.

Excel fails miserably here as it does not provide you with any support to look at the big picture.

Invoicing software keep a count of all such metrics. One look and you can be aware of the number of outstanding invoices and the number of outgoing quotations.

But that’s not it...

7. No Payment Reminders

Do you ever find yourself thinking long and hard before reminding a client about pending payments? Certain customers can sometimes take offense at the frequency of reminders or the way in which they are received.

If you are invoicing with Excel, it leaves you no choice but to call or email your clients while trying to hide your disappointment about the unpaid invoices.

On the other hand, invoicing software help, you send automated system generated reminders that smartly tell the clients, “Hey! I am an automated email, and I mean no harm! We care about you enough to not push you for payments so you might as well pay us timely.”

8. Lack of Portability

Spreadsheets can’t go everywhere you do (well unless you carry them around in a pen drive while praying that you don’t lose it).

Moreover, in a world that is increasingly being driven by touchscreen devices that fit in our pockets, it is difficult to work on spreadsheets on the go.

Invoicing software solve this by saving all documents on the cloud and enabling you to access them with mere login credentials. Such empowering technology can only be a welcomed guest in any company.

9. No Tax Assistance

Doesn’t Excel bore you to death with all the recurring tax calculations that you have to do every time you prepare a new invoice?

Even if you are a math geek who enjoys calculations, you are only human at the end of the day and mistakes are bound to crop up more often than not.

Invoicing software take away this ambiguity by automatically calculating the relevant tax amount and adding it to the invoice.

Moreover, it does not end here.

Even tax reports can be generated that can bring you to speed about the ongoing tax and compliance expenses at your organization.

I am sure you can find Excel hiding in the shadows by now.

10. No Archiving Of Invoice

Depending on the country and tax authority it's been stipulated on how long an invoice has to be stored, you need to archive your invoices for such period. It may vary from few months to few years. In Germany, an invoice must be held for 10 years. In the UK, documents have to be archived for six years. And if you consider that on average you generate 1000 invoices per year, then just imaging, how to manage that in Excel? Or are you going to print and file them?

With Invoicing software this problem is already taken care you can archive all previous year Invoices, for a number of years, as long as you want or even forever.

If you have read this far, you must have understood, why Excel is unfit for generating invoices. If you want to ensure no invoicing blunders and keep your financial status healthy, consider replacing Excel with hassle-free invoicing software such as Shimbi Invoice.

Note: Shimbi Invoice is also now India GST complaint. You can read all about the amazing software here.

More Read

- Why e-invoices are better than paper invoices

- 7 Reasons you need auto invoice generator for your small business or startup

- 10 Effective invoicing tips for Better Invoicing

Over to you

If Excel and Invoicing software were superheroes, who do you think would win the duel? Share your views below!